Welcome back to The PHENOM Update, our official monthly newsletter where we keep you updated on recent goings on in our campaigns and around the higher ed world!

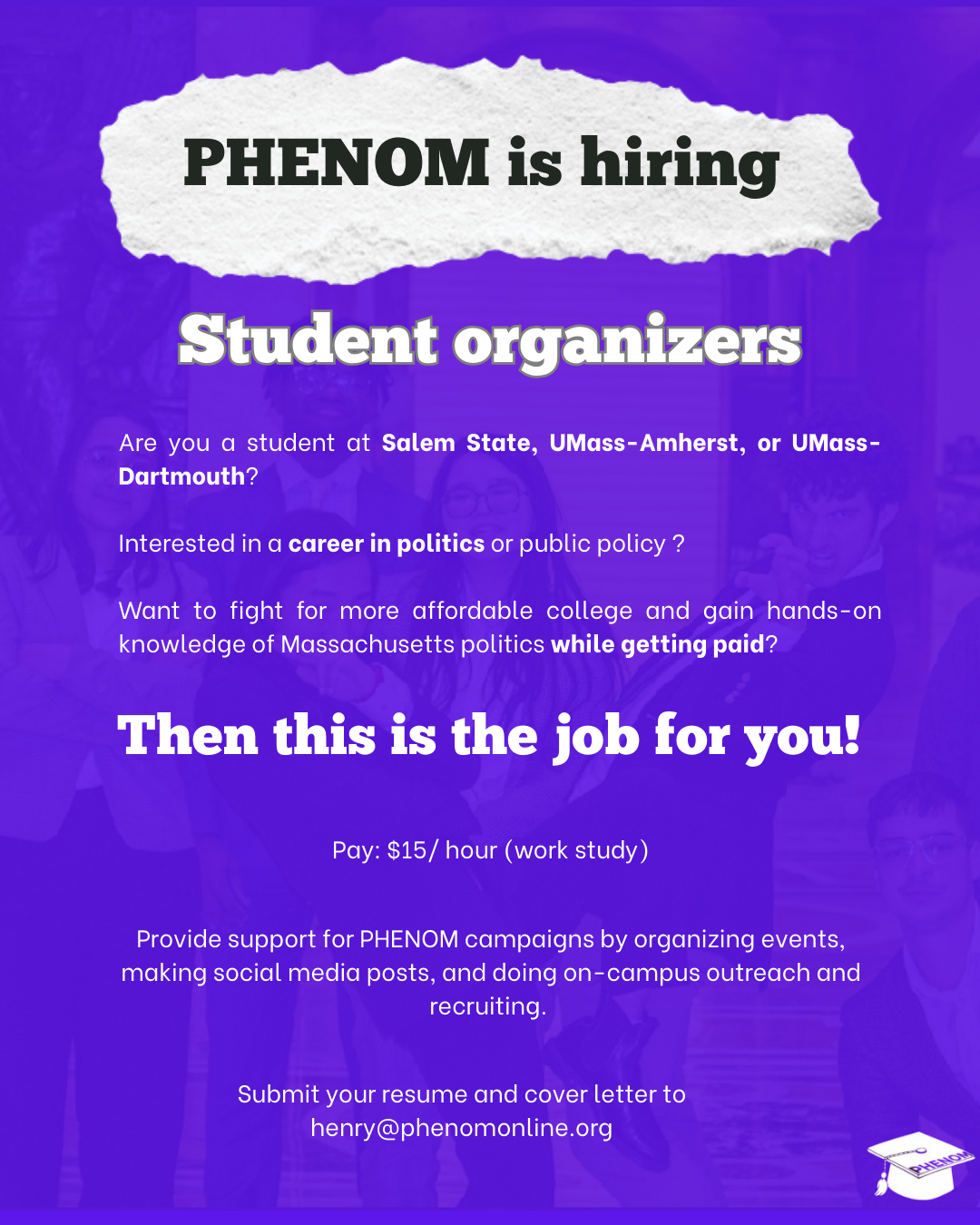

PHENOM is hiring student organizers at Salem State, UMass-Dartmouth and UMass-Amherst!

PHENOM is hiring passionate and organized interns at our Salem State, UMass-Dartmouth and UMass-Amherst chapters!

Under the guidance of our executive director and president, PHENOM’s student organizers will lead organizing and communications efforts to grow support for PHENOM’s key campaigns for causes such as financial aid reform, tuition-free college and campus free speech!

Student organizers will organize events, make phone calls, make social media posts for events and meetings, meet with relevant parties such as allies, union leaders and legislators, manage and recruit other students, spread awareness about PHENOM through outreach to student organizations and classes.

These positions are work study and pay $15 per hour, and last the duration of the academic year. Student organizers who are successful in this role will be encouraged to reapply for the following year if interested.

For more information on the role and how to apply, view the postings on our website or on Handshake.

PHENOM volunteers and allies urge Boston lawmakers to support free college and improved financial aid access!

On July 18th, PHENOM advocates and volunteers came together at a Beacon Hill hearing to urge lawmakers to support two PHENOM bills that would make our colleges vastly more affordable and accessible. These are the Debt-Free Future Act (HD.1473/SD.300) and the Financial Aid Reform Act (SD.2477/HD.2461). (Check out our July newsletter or check out our Campaigns page for more info on these bills!)

To summarize, the Debt-Free Future Act (HD.1473/SD.300) would make all public universities in Massachusetts completely tuition-free, regardless of income.

Meanwhile, the Financial Aid Reform Act (SD.2477/HD.2461) would ensure bright students get the financial aid they need to attend college by streamlining Massachusetts’ financial assistance process.

In addition to the outpouring of in-person support, PHENOM was blessed to submit multiple written testimonies from passionate students and professors from all kinds of backgrounds.

“As a professor within the state university system, seeing the caliber of our students and the manner in which developed nations do not burden their young citizens… I firmly believe in the ability of all Americans to have access to high-quality education, and the mission and methods of PHENOM,” notes UMass-Amherst professor Edie Maidav. “Please support this worthy cause for our greatest community, commitments, and the hope of our future!”

“My friends will graduate with monthly payments of hundreds of dollars that will span decades,” writes student Liana Rosenblum. “It’s a huge cloud looming over so many students.”

“Many [students] are pursuing college degrees as an avenue to rise out of the cyclical poverty of their family”, she continues. “But it seems to me that our system isn’t designed to allow [anyone to] rise out of that cycle. Instead, they enter the same crushing cycle of debt that they are working to get out of.”

“I am ecstatic to say that being at a University has contributed to the best times in my life… I have the opportunity to wake up and go to class, but I am frustrated by the fact that as of this date, I am over $40,000 in debt to UMass Amherst,” writes UMass-Amherst student Beatrice Rogers. “When I will be able to pay this back, I have no idea. It looms and it will linger and it will never go away.”

“A debt-free future is not just a cost, but it is an investment in the lives of every person, their dreams, and ultimately, our future,” Rogers concludes.

“My younger sister’s story shows what [tuition-free college] can do,” writes Massachusetts Democratic State Delegate and UMass-Amherst student Charles Goodchild.

Goodchild tells the inspiring story of his sister, who overcame debilitating mental health struggles to earn her GED and now attends community college for free thanks to Massachusetts’ free community college program MassEducate. Even better, she is now set to transfer to UMass-Amherst a year early as a result.

Still, “beyond personal stories, this policy is practical and economically feasible”, Goodchild points out. As Goodchild notes, the nation of Denmark has about as many people as Massachusetts, is 2/3rds as wealthy, but they have universal free college while the Bay State somehow does not.

“As a psychology major hoping to enter graduate school, my finances are a huge stressor for me,” writes Salem State student and PHENOM student-organizer Nephthys Elbayoumi. “I have to take out multiple loans and work long hours outside of and during the school year when my main focus should be on my studies.”

“In many cases I receive money when it is too late and I have already had to pay a large amount myself,” Elbayoumi also notes. “As students, we should be focusing on being STUDENTS!”

“It’s a disheartening feeling like you have to choose between survival and a better future,” says UMass-Amherst rising sophomore and PHENOM volunteer Jelani Tah while discussing the unique challenges of affording college as a first-generation student.

“That is why the Debt Free Future Act is so revolutionary,” Jah continues. “With all the amazing resources this state has, I see no reason why the chance for future success should be limited to those who already have a considerable amount of wealth.”

Thank you to all who showed up at the 7/18 Legislative Hearing! We hope to keep this momentum for October when another legislative hearing is posted.

PHENOM members and allies in attendance, from left to right: Abigail Raymond (UMass Boston Student Trustee), Michael Borowski (UMass Amherst SGA President), Ella Prabhakar (PHENOM President), Ruo Wu (PHENOM Organizing Chair), Henry Morgan (PHENOM Executive Director), and Joshua Rand (Sunrise Movement). (Credit: Ella Prabhakar).

In other news:

Mass. free community college presses on, transforming students’ lives

Despite the uncertainty around higher education funding under the Trump administration, Massachusetts’ free community college programs have continued opening doors for tens of thousands of students across the state: Massachusetts’ two free community college programs, MassEducate and MassReconnect, have helped 15,000 more students enroll in community colleges across the Commonwealth since their creation.

As successful as Massachusetts’ free community college programs are, though, they still have room for improvement. As the Globe article notes:

“the programs cover only tuition and fees. Those costs make up just 44 percent of the roughly $23,000 annual cost of attending community college. Students still have to pay for child care, transportation, food, and housing.”

Since students are only eligible for these programs if they do not already have enough aid, paradoxically the low-income students most in need of more funding are ineligible since they already have access to Pell Grants. As such, low-income students get Pell Grants to cover tuition and fees, but cannot get any help with the other 56 percent of expenses for things like transportation and housing.

This could all be fixed if these programs were redesigned as “first-dollar” programs, meaning they would cover the cost of tuition automatically. That way, low-income students could use their Pell grants to cover their additional costs since Pell grants can be used for any valid costs relating to attending college.

Survey: Families spending more on college due to lack of financial aid information

A recent survey of 1000 undergrad students by Ipsos and Sallie Mae found that families are spending 9 percent more on college compared to last year at $30,837 per year on average.

Unfortunately, the survey finds a key factor in the rising costs of college is families’ lack of information about financial aid opportunities: 40 percent of families surveyed did not seek scholarships because they either did not know where to find them or simply did not believe they could win one. As a result, only 47 percent of students paid less than the sticker price.

Relatedly, another study by the National College Attainment Network (NCAN) found that 45 percent of low-income students did not complete the FAFSA because they did not believe they would qualify for financial aid. Of those who did not apply, 20 percent said they feared student debt, 15 percent said they did not have enough information about how to apply, and 15 percent thought the FAFSA was too time consuming. In the same vein, 11 percent opted not to apply because of the numerous problems of last year’s FAFSA.

Particularly alarming is how few low-income students applied even though they are the most eligible: 48 percent of students identified as low-income did not complete the FAFSA since they believed they would not qualify.

To NCAN senior analyst Bill DeBaun, these low rates of FAFSA completion represent a massive failure of colleges and the government to keep students and families informed about all the financial aid opportunities. But a lack of communication is only part of the problem: the Ipsos and Sallie Mae survey also noted that grants and scholarships only paid for 27 percent of college costs on average, while families typically paid for half with their own money.

When financial aid covers such a small portion of college and families pay $30,000 per year on average, is the greatest problem a lack of information or a lack of financial aid to begin with?

Foreign-student enrollments could nosedive this fall

As international students across the nation grapple with sudden visa revocations and reinstallments.

The Trump administration has created nothing short of a nightmare for the incoming international class. After the State Department suspended visa interviews for students, only 5 percent of applicants said appointments were easy to schedule, according to the Association of International Enrollment Management. A likely result is a substantial drop in international student enrollment

In response, NAFSA, the National Association of Foreign Student Advisers, is urging the U.S. Department of State to provide expedited appointments and visa processing for applicants for student and scholar visas. A failure to see a return in international student enrollment could reportedly lead to as much as $7 billion dollars in losses.

International students stimulate state and local economies, create jobs, and subsidize the cost of education for domestic students. Beyond these economic arguments, the cultural exchange and enrichment of perspectives that an international student body allows is a form of education in its own right.

More headlines:

Programming for first-gen students of all degree paths

The strange history of university autonomy — and why we need it more than ever