Student debt is now the second largest form of debt held by people in the United States. Over $1.5 trillion in student loans are outstanding, with nearly two-thirds of that amount being held by women. If you want to go to college in the U.S. and you aren’t rich, you are almost guaranteed to take out at least some form of student loans. However, student loan borrowers don’t even have the same basic protections provided to mortgage loans, car loans or even credit card debt. We have to change that in Massachusetts.

The Student Loan Bill of Rights would provide all student loan borrowers in the state with the basic consumer protections they deserve. In addition, the bill cuts through the red tape intentionally created by student loan servicers and creates a Student Loan Ombudsman, a single office under the Attorney General where borrowers can get the information they need about their loans. Click here to download our print factsheet.

The Student Loan Bill of Rights passed the Massachusetts Senate unanimously on April 11th, 2018. However, it did not receive action in the Massachusetts House of Representatives. Now, it has been refiled for the new session beginning in January 2019, and we will be working to see its passage.

Massachusetts is part of a national movement to protect student borrowers and would follow Connecticut, Washington and many other states who have either passed a Student Loan Bill of Rights or who are considering doing so.

PHENOM worked with “The Loan Rangers,” a student law office of about 15 Northeastern University School of Law students, to analyze the Student Loan Bill of Rights, create a “Know Your Rights” guide for student borrowers and suggest amendments to the bills currently being moved through the State House. We are proud to say that some of these changes made it into the bill that passed the Massachusetts Senate in April 2018. Read their report on the Student Loan Bill of Rights here.

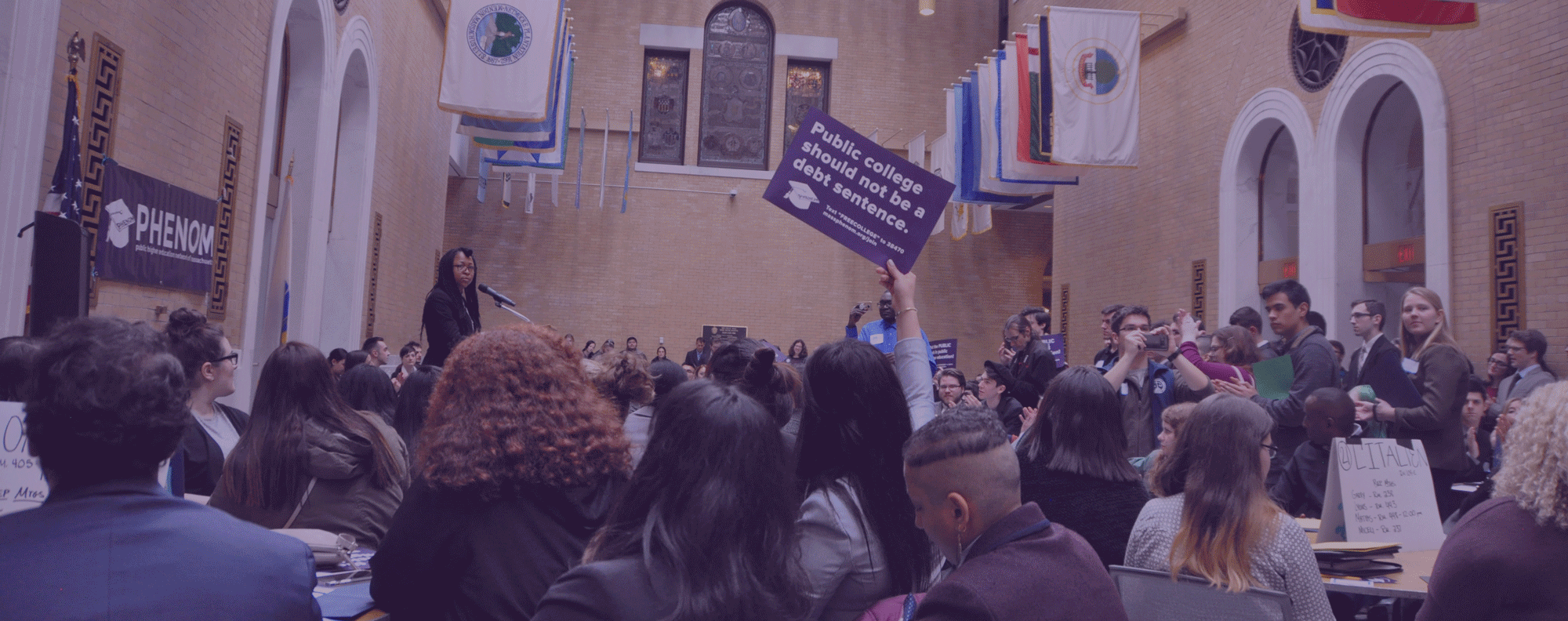

The Student Loan Borrowers Bill of Rights just passed the Massachusetts State Senate 36-0! Here’s Northeastern University School of Law student and PHENOM partner Sarah Pavlini talking about why student borrowers need these protections. Thank you to Senator Eric Lesser and State Representative Natalie Higgins for leading on this issue.

Posted by PHENOM (Public Higher Education Network of Massachusetts) on Wednesday, April 11, 2018

PRESS COVERAGE

April 2018

Leslie Marshall Show: “Rep. Natalie Higgins and PHENOM’s Zac Bears on the Student Loan Bill of Rights”

The Atlantic: “Why Would the Government Stop States From Helping Student Borrowers?”

MassLive Editorial: “State should take lead in protecting student debtors”

MarketWatch: “Massachusetts defies Trump administration with crackdown on student loan debt”

MassLive.com: “Mass. Senate passes student loan regulations, setting up clash with Trump administration”

New England Public Radio: “Student Debt Is ‘Poisoning Everything Else In Our Economy,’ Says Sen. Eric Lesser”

Valley Advocate: “Massachusetts readies for legal fight over ‘Student Loan Bill of Rights’”

AP/Boston.com: “Massachusetts Senate OKs bill aimed at student loan lenders”

WBUR: “Massachusetts Senate OKs Bill Aimed At Student Loan Lenders”

Daily Hampshire Gazette: “State Senate passes student loan bill of rights”

Public News Service: “Student Loan Bill of Rights Passes Mass. Senate”

The Student Loan Report: “Massachusetts May Face Legal Battle Over Student Loan Bill of Rights”

WWLP-22 News: “Bill aims to end predatory student loan services”

Lowell Sun: “Senate OKs ‘student loan bill of rights’”

Western Mass News: “Massachusetts Senate OKs bill aimed at student loan lenders”

U.S. News & World Report: “Massachusetts Senate OKs Bill Aimed At Student Loan Lenders”

WHDH-7 News: “Massachusetts Senate OKs Bill Aimed At Student Loan Lenders”

BU Daily Free Press: “Massachusetts on path to regulate student loan servicers”

Amherst Bulletin: “UMass students push for affordable college”

Greenfield Recorder: “Panel tackles college affordability”

MetroWest Daily News: “Sherborn’s state senator supports student loan bill of rights”

Auburn Mass. Daily: “Student Loan Bill of Rights to Protect Borrowers”

MassPIRG: “Mass. Senate Passes Much Needed Consumer Protections for Student Loan Borrowers”

PHENOM: “Students and Advocates Support Student Loan Bill of Rights”

March 2018

WBUR: “As Costs Climb At Public Colleges, State Leaders Weigh Fixes — But Students Demand More”

Boston Globe: “Mass. students borrowing more to attend public universities”

Boston Business Journal: “Massachusetts’ rising student debt said to hurt local businesses”

MassLive.com: “Trump policy threatens Massachusetts’ regulation of student loans”

Daily Collegian (UMass): “Letter: UMatter at UMass, but do you matter in Massachusetts?”

MassBudget: “Educated and Encumbered: Student Debt Rising with Higher Education Funding Falling in MA”

Fall 2017

American Prospect: “States Take on Student Debt Abuses as the Trump Administration Defaults”

MassLive.com: “After DeVos rescinds protections, Massachusetts mulls regulations for student loan industry”

Massachusetts Jobs With Justice: “A Student Loan Borrowers Bill of Rights”

Spring 2017

MassLive.com: “It’s time for a student loan bill of rights in Massachusetts (Guest Viewpoint)”

MassLive.com: “Do Massachusetts college students need a borrower’s bill of rights?”

Supporters and Endorsers

PHENOM (Public Higher Education Network of Massachusetts)

Massachusetts Education Justice Alliance

Massachusetts Teachers Association

American Federation of Teachers Massachusetts

Boston Teachers Union

Youth On Board

Citizens for Public Schools

MASSPIRG Student Chapters

Consumer Federation of America

Consumer Action

What is the Student Loan Bill of Rights?

State legislators, many hearing from their constituents, or managing student debt loads themselves, began exploring ways to protect borrowers at the state level in recent years. The first significant piece of state legislation to address these concerns in a comprehensive way is the Borrower’s Bill of Rights (BBOR). This state legislation gives students and their families additional rights and protections as they navigate the loan repayment process.

In 2015, Connecticut became the first state to pass a Borrower’s Bill of Rights into law. Because of the bill, the state established a student loan ombudsman in the Connecticut Department of Banking, paid for by fees levied on student loan servicers. In the state, student loan servicers must now register with the Department of Banking, and the ombudsman is tasked with helping students resolve complaints with these servicers and with their universities. The ombudsman also compiles data on borrower complaints and develops a student borrower education course to help improve financial literacy among college students. The Connecticut bill has remained the blueprint for proposals in 13 states and the District of Columbia.

The core of a Borrower’s Bill of Rights is the use of a state’s licensing authority to enshrine consumer protections for borrowers. These proposals by the legislatures come in different forms, but many have similar provisions. They ensure student loan borrowers receive levels of service that are standard for other financial contracts, but are not currently guaranteed by federal law. They create a legal mechanism for states to use if borrowers in their state do not get the assistance mandated. And they create an independent advocate to help borrowers get relief.

What Makes Up A Borrower’s Bill Of Rights (BBOR)

- Servicer state licensing. States currently use their licensing authority to regulate mortgage lenders and federal debt collection agencies that operate within state authority. A BBOR codifies the inclusion of student loan servicers under that authority. Once student loan servicers are covered by state authority, the state can establish licensing requirements for them that set standards of practice.

- Standards for servicing. A BBOR should establish minimum standards for timely payment processing by loan servicers, and require servicers to correct errors in payment processing in a timely manner. A BBOR should also require that loan servicers disclose alternative repayment plans for the loans they hold. This is especially important for borrowers struggling with monthly payments, or who are in delinquency or default, and may be eligible to enroll in income-driven repayment programs.

- Data reporting. Once covered by state authority, states may also create regular reporting requirements for student loan data to appropriate state agencies. Reporting requirements generate crucial data that regulators can use to detect servicing issues. Reporting should include the number of borrowers, outstanding loan balances, loan type, enrollment in alternative repayment programs, and other key information. This information should be made publicly available.

- Ombudsman establishment. Ideally, the servicer state licensing agency is also set up to house a state student loan ombudsman’s office. For example, in Connecticut, the authority is housed in the Department of Banking and the student loan ombudsman is appointed by the banking commissioner. The establishment of a state student loan ombudsman, as part of a BBOR, is important to give borrowers a watchdog and resource at the state level for complaints. The ombudsman serves as a formal repository that allows borrowers who complain to have a neutral party investigate allegations and work to resolve them. In current BBOR efforts this position is based on, and meant to cooperate with, the federal student loan ombudsman housed at the Consumer Financial Protection Bureau. Ideally, the state ombudsman would require student loan companies to include the ombudsman’s contact information in any communication with a borrower. The ombudsman would also provide testimony before relevant state legislative committees and provide regular reports on efforts to assist borrowers based on an assessment of the complaints it receives, and give policy recommendations to resolve issues it encounters with loan servicing based on the state laws.

Thanks to Generation Progress for providing these details!

Why is the Student Loan Bill of Rights Important?

The presence of a Borrower’s Bill of Rights in a state will help students and borrowers navigate the repayment process in a way that allows them to pay down debt more sustainably and address servicing issues with a state advocate by their side. Currently, governed by only federal standards, many servicers fail to inform borrowers of these important programs which help borrowers fend off financially catastrophic student loan default.

An additional benefit for borrowers is assistance and requirements that ensure servicers are addressing payment errors in a timely way, and that they are notifying borrowers of changes in their loans as they happen. This type of notification is standard practice in other lending markets—the mortgage market, for example—and a BBOR can allow a state to bring this financial services best practice into the student lending market.

Finally, a BBOR that includes a student loan ombudsman gives borrowers an in-state advocate that they can contact with complaints or questions and gives them one more resource for navigating repayment. This is an important benefit, as student loan repayment is complicated, and a cottage industry of “debt-relief companies” has sprung up in recent years to take advantage of borrowers who may not know their options. An in-state advocate can help get borrowers the information they need without them having to pay an exorbitant fee.

Thanks to Generation Progress for providing these details!