Summary

- The Endowment Tax Act would levy a 2.5 percent tax on all Massachusetts private universities with endowments exceeding $1 billion. The projected revenue of this tax (over $2 billion) would pay for free public college in MA.

- It would punish elite institutions for refusing to use their immense wealth to educate more students, holding them to their mission of public service.

- Despite fear-mongering from officials at these colleges, this 2.5 percent tax would not endanger taxed colleges’ finances.

The Endowment Tax Act (HD.1474/ SD.948) would tax all Massachusetts universities with endowments of more than $1 billion and use all revenue to massively boost funding to public higher education.

If passed, the 2.5 percent tax it would levy would generate at least $2 billion per year as of 2023 according to its House sponsor, Natalie Higgins (D-Leominster). This would fully fund making all of Massachusetts’ public colleges tuition-free through the Debt-Free Future Act.

Diving Deeper

The Endowment Tax is so promising not just because it would generate direly-needed funding for our public universities, but also because it would punish the wealthiest universities for failing to educate more students.

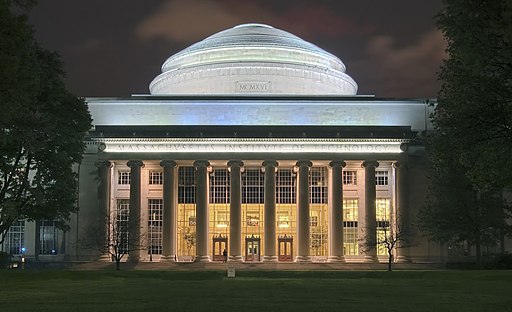

Over the past half-century, elite institutions such as Harvard, MIT and Amherst College have grown exponentially richer while refusing to enroll more students. Harvard alone has increased its endowment eightfold since 1978. And yet, they educate almost the same amount of students it did 50 years ago.

Without a doubt, all private colleges need generous reserves of money in order to stay in business. After all, the whole point of their existence – or so they claim – is to serve the public through education. But how accurate are these colleges’ claims of serving the public when they only educate a fraction of the students they could afford to?

If these universities refuse to use their money to educate more students, we the people have the obligation to tax them for it. By taxing just a tiny sliver of these universities’ wealth through the Endowment Tax, Massachusetts can rein in these universities’ greed and use their money to educate all of the bright students these ultra-wealthy schools refuse to.

But wait, what right does Massachusetts have to tax these private universities if it’s their money? You may ask.

That is the catch: it is not exactly their money.

Harvard and company did not earn their present fortunes by themselves: these ultra-rich institutions have used stock market profiteering in the form of hedge funds and private equity to balloon their endowments beyond proportion.

Just in 2016, as Astra Taylor of The Nation reported, “experts I consulted estimate that over $100 billion of educational endowment money nationwide is invested in hedge funds, costing them approximately $2.5 billion in fees in 2015 alone.”

This calls into question whom these colleges are serving: their students, or the Wall Street barons running them.

As Julien Berman of the Harvard Crimson writes, “In 2014, five rich institutions including Harvard paid more to private equity fund managers than they dished out in aid to their entire student bodies.”

Meanwhile, another study Berman noted found that endowment increases have no effect on tuition. In other words, Harvard getting more money is not making it any more affordable.

Given the growing push to tax Wall Street more for their often exploitative speculation, shouldn’t we do the same for universities that call themselves non-profits yet have spent the last few decades making billions in profits from speculation on Wall Street?

It wasn’t always this way: as UC Merced economist and “Bankers in the Ivory Tower” author Charlie Eaton notes, the obscene wealth of these colleges only began in the 1970s.

At this time, the growing power of the finance industry led universities to increasingly bring in hedge fund managers to invest their funds intended for education into the stock market. “[F]inanciers helped Princeton increase its endowment by 847 percent from $2 billion in 1973 to $22 billion in 2016,” Eaton said.

Fortunately, these universities have so much extra money from Wall Street speculation that the Endowment Tax would not hurt them at all. At 2.5 percent of their endowments exceeding $1 billion, it would even allow these universities to continue growing their endowments.

The Harvard Crimson found that the ETA would cost Harvard $14.6 billion by 2034 if passed. Tragically for Harvard, if we pass the Endowment Tax, the Cambridge university would have only $69 billion instead of the originally projected $90 billion. How will they ever manage?!

Harvard, MIT and other elite universities with endowments over $1 billion have so much money that they could create entirely new campuses and educate thousands more students.

Because these colleges refuse to use their vast riches for the students they claim to serve – and because they have gained most of that money through shady Wall Street investments anyway – we have every reason to tax them for it.

Of course, the Endowment Tax is by no means a silver bullet to the wide range of other challenges Massachusetts’ state schools face today, from the mistreatment of adjunct faculty to our messy financial aid system to the crippling student debt crisis. But passing the Endowment Tax would give us the momentum and funding necessary to face these problems head on.

Passing this bill is not just about more funding. It is about sending a message: the ultimate service of any university must be to the people. And if they fail in that mission, it is the people’s job to hold them to account.

Testimony

““I think that it’s especially important that [Amherst College] try to use the endowment in a way that promotes service and that promotes education for people and that serves the greater good.”

Melanie Huq, Amherst College ’25

“Not every student has the opportunity to go to Harvard or MIT, but their endowments have the opportunity to make sure every single resident of Massachusetts can get a college degree,”

Natalie Higgins, state representative

Read about us in: