Beacon Hill must invest in higher education to oppose Trump’s cuts.

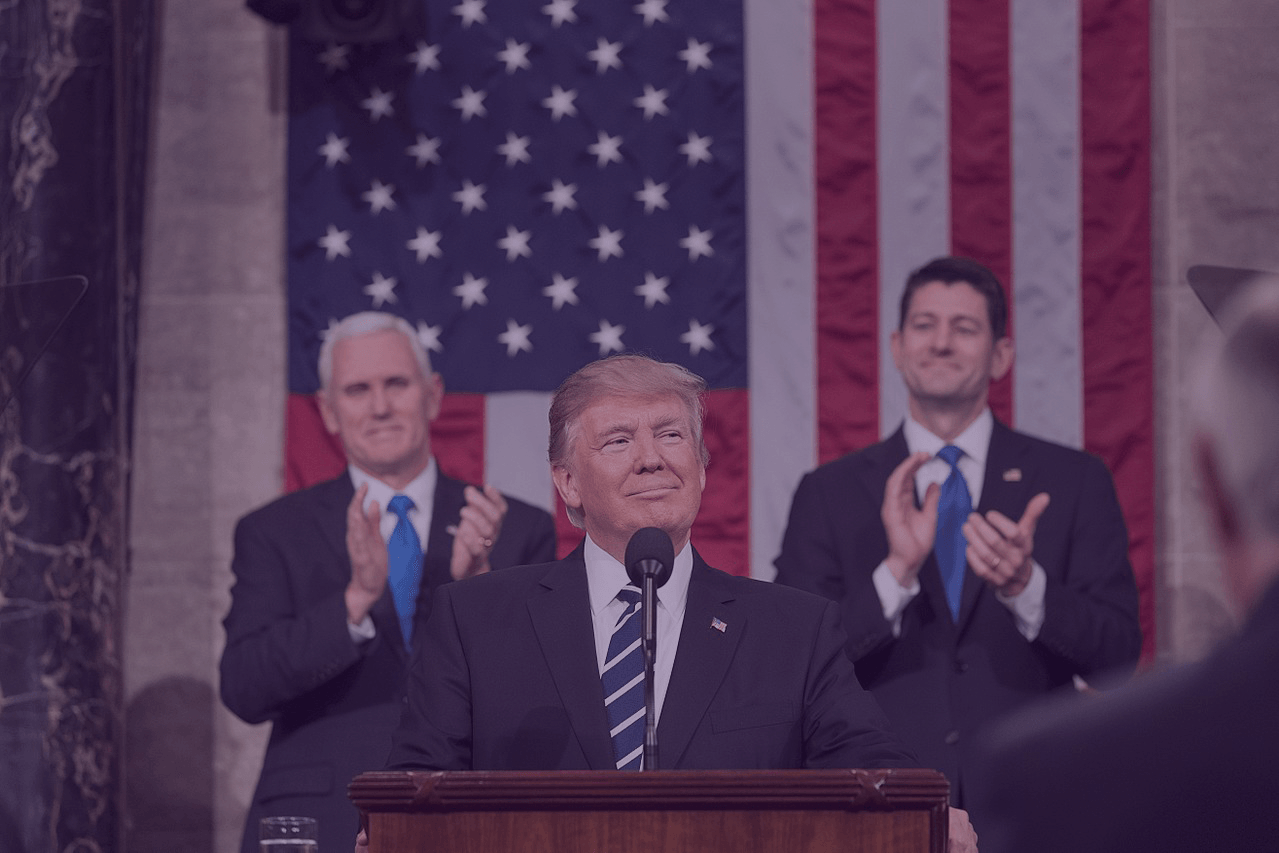

Photo: Paul Ryan and Mike Pence cheer on Donald Trump. (Shealah Craighead/The White House)

The national tax cut bill proposed by House Republicans and Donald Trump takes billions of dollars away from students and families in order to pay for tax cuts for corporations and billionaires.

Included in the proposal are: cuts to most higher education tax credits for current students, elimination of the tax deduction for student loan payments and the removal of billions of dollars from the Pell Grant surplus fund.

In total, Republicans cut $65 billion per year in higher-ed related benefits, and does not reinvest any funding into colleges and universities.

“This ‘Reverse Robin Hood’ plan deeply hurts students and families who are already struggling under the heavy burden of high costs and massive student debt,” said Zac Bears, executive director of PHENOM. “It is also a call to action to lawmakers on Beacon Hill to begin a serious program of reinvestment in public colleges and universities in Massachusetts.”

PRESS COVERAGE

WGBH: “Higher Ed Leaders Question Priorities Of House Tax Overhaul Plan”

NPR National Newscast: November 3rd at 8AM, 0:50 seconds in.

Massachusetts is currently 42nd out of 50 states in terms of state funding for higher education, with only eight states spending less as a percentage of income on college quality and affordability.

In the bigger picture, the bill ends federal tax deductions for state and local tax payments, requiring greater political courage from state lawmakers to find the funds to invest in public goods like our public higher education system.

At the end of the day, this is just another GOP atrocity, a trillion dollar tax cut for the rich that takes already-limited benefits away from working people.

We should be investing in public colleges, not cutting benefits to give tax cuts to the rich. Now it’s up to Massachusetts to make that commitment on our own. Washington won’t be helping any time soon.